Hsmb Advisory Llc Can Be Fun For Anyone

Hsmb Advisory Llc Can Be Fun For Anyone

Blog Article

The 2-Minute Rule for Hsmb Advisory Llc

Table of ContentsNot known Details About Hsmb Advisory Llc How Hsmb Advisory Llc can Save You Time, Stress, and Money.Hsmb Advisory Llc Things To Know Before You BuyThe Main Principles Of Hsmb Advisory Llc Examine This Report on Hsmb Advisory LlcRumored Buzz on Hsmb Advisory LlcHsmb Advisory Llc - Truths

Be mindful that some policies can be pricey, and having particular wellness conditions when you use can enhance the costs you're asked to pay. You will need to ensure that you can pay for the costs as you will need to devote to making these payments if you desire your life cover to continue to be in positionIf you really feel life insurance policy could be valuable for you, our collaboration with LifeSearch allows you to obtain a quote from a variety of service providers in dual double-quick time. There are various kinds of life insurance policy that intend to meet different defense demands, including level term, reducing term and joint life cover.

Rumored Buzz on Hsmb Advisory Llc

Life insurance coverage supplies five financial advantages for you and your household (Health Insurance). The major advantage of including life insurance policy to your economic strategy is that if you pass away, your heirs obtain a round figure, tax-free payout from the plan. They can utilize this money to pay your last expenses and to change your earnings

Some policies pay if you establish a chronic/terminal illness and some provide financial savings you can utilize to support your retired life. In this post, discover the numerous advantages of life insurance and why it might be a great idea to buy it. Life insurance coverage uses advantages while you're still to life and when you pass away.

Some Known Details About Hsmb Advisory Llc

If you have a policy (or plans) of that dimension, the people that depend on your revenue will still have cash to cover their ongoing living expenditures. Beneficiaries can make use of policy benefits to cover critical everyday expenses like lease or home mortgage repayments, energy bills, and grocery stores. Average annual expenditures for houses in 2022 were $72,967, according to the Bureau of Labor Stats.

The Best Strategy To Use For Hsmb Advisory Llc

Development is not influenced by market problems, enabling the funds to collect at a secure price with time. In addition, the cash money worth of entire life insurance grows tax-deferred. This means there are no income taxes built up on the cash money worth (or its development) up until it is withdrawn. As the cash worth develops with time, you can utilize it to cover costs, such as acquiring a cars and truck or making a down settlement on a home.

If you decide to obtain against your cash worth, the financing is not subject to revenue tax as long as the policy is not given up. The insurer, nonetheless, will bill passion on the financing quantity until you pay it back (https://www.callupcontact.com/b/businessprofile/HSMB_Advisory_LLC/9007265). Insurance business have differing rates of interest on these loans

Unknown Facts About Hsmb Advisory Llc

8 out of 10 Millennials overstated the cost of life insurance in a 2022 research study. In reality, the average price is closer to $200 a year. If you think investing in life insurance policy might be a wise monetary relocation for you and your family, take into consideration consulting with a monetary consultant to adopt it into your financial plan.

The 5 main types of life insurance are term life, entire life, universal life, variable life, and last cost protection, additionally recognized as burial insurance policy. Entire life starts out costing extra, however can last your entire life if you maintain paying the premiums.

See This Report on Hsmb Advisory Llc

It can pay off your financial obligations and clinical bills. Life insurance policy could likewise cover your home mortgage and offer cash for your family to keep paying their costs. If you have family depending upon your revenue, you likely require life insurance policy to sustain them after you die. Stay-at-home parents and company owner also commonly require life insurance.

For the many part, there are two sorts of life insurance plans - either term or irreversible strategies or some mix of both. Life insurance providers provide different forms of term strategies and typical life plans in addition to "rate of interest delicate" products which have come to be extra widespread considering that the 1980's.

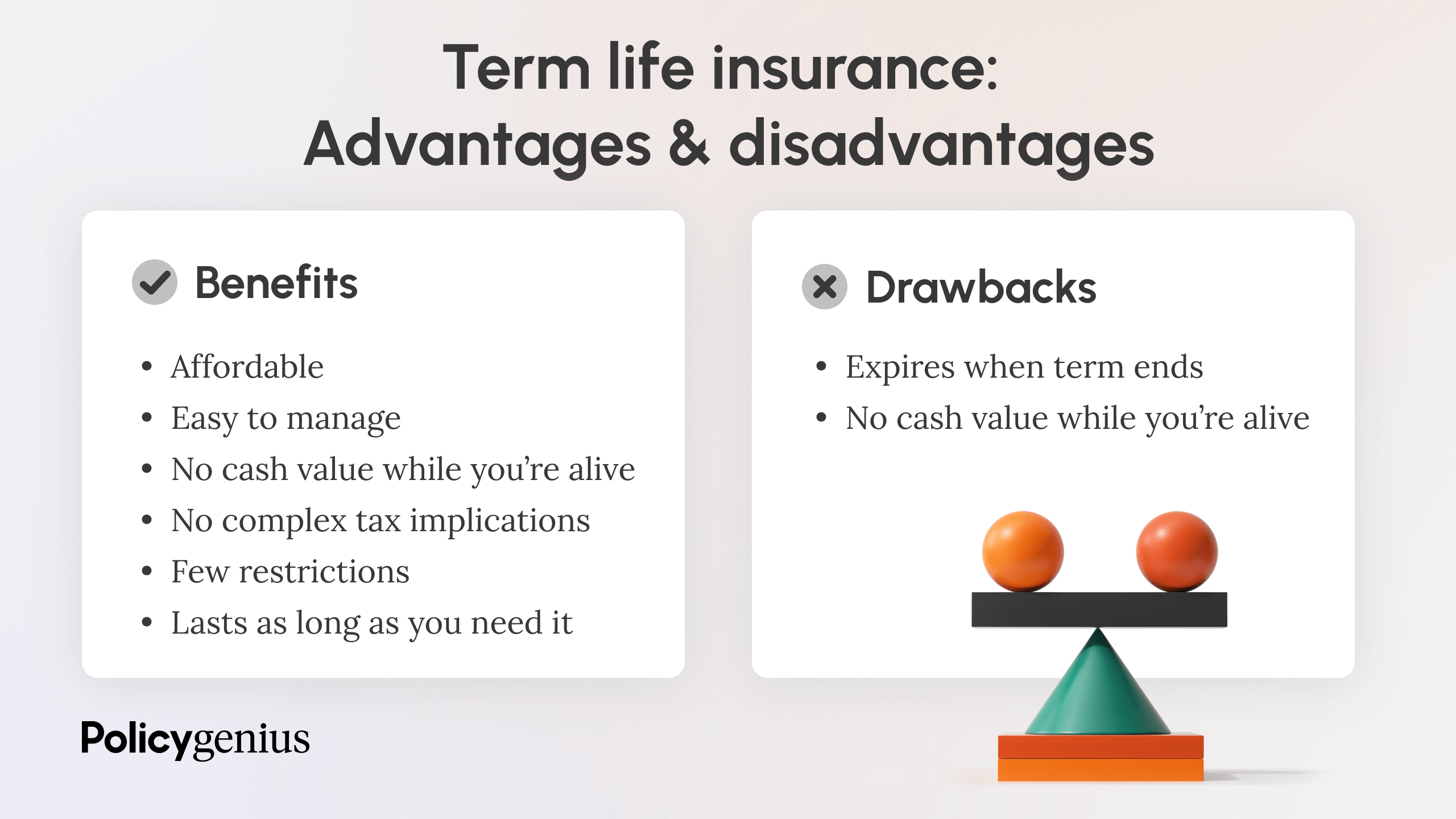

Term insurance coverage provides defense for a given time period. This duration might be as short as one year or provide insurance coverage for a certain number of years such as 5, 10, two decades or to a defined age such as 80 or in some cases up to the earliest age in the life insurance policy death tables.

What Does Hsmb Advisory Llc Mean?

Presently term insurance coverage prices are go to these guys very competitive and amongst the most affordable traditionally skilled. It must be noted that it is a commonly held idea that term insurance is the least costly pure life insurance policy coverage available. One requires to assess the policy terms thoroughly to determine which term life options appropriate to fulfill your certain situations.

With each brand-new term the costs is increased. The right to restore the policy without evidence of insurability is an essential benefit to you. Or else, the threat you take is that your health may degrade and you might be incapable to obtain a policy at the same rates or even in any way, leaving you and your beneficiaries without coverage.

Report this page